Leasing market likely to remain challenging

THE leasing market for prime office space in Kuala Lumpur is expected to remain challenging as new supply comes in.

Rents for older buildings in the Golden Triangle may come under pressure as landlords look for tenants to backfill space vacated by companies that are either downsizing or moving out of the area.

The Golden Triangle is the premium business district with a high concentration of tenants from the banking, insurance and services sector.

It is also Kuala Lumpur’s main shopping and nightlife district, as well as home to four- and five-star hotels.

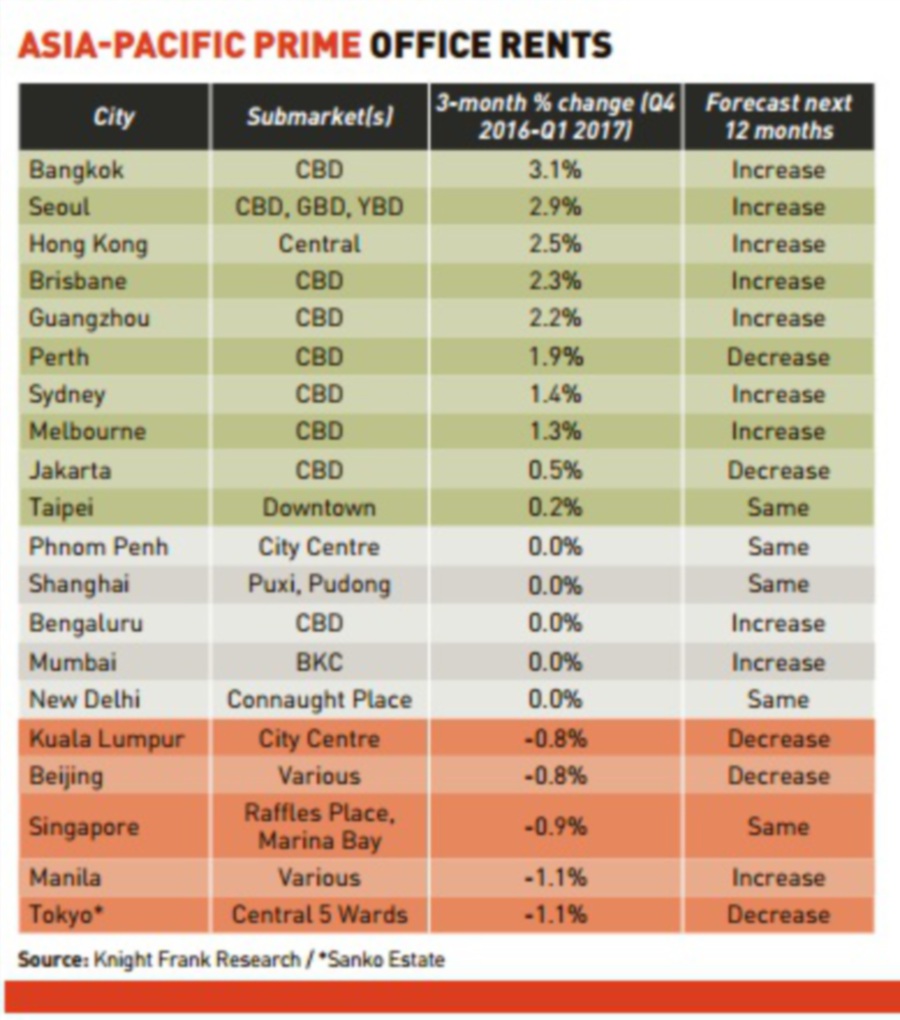

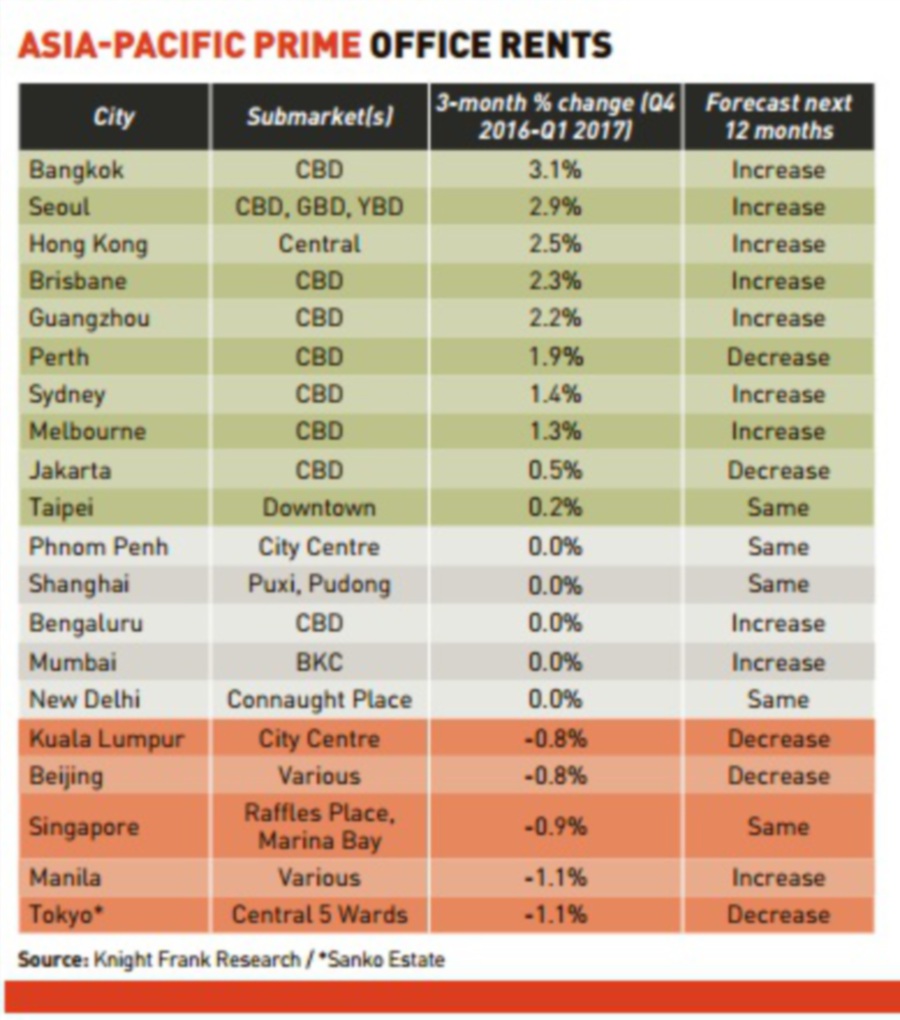

According to the Knight Frank Asia-Pacific Prime Office Rental Index for the first quarter of this year, rent in Kuala Lumpur quarter-on-quarter declined by 0.9 per cent and 0.8 per cent respectively, with the market anticipating significant incoming supply this year.

Knight Frank Malaysia executive director of corporate services, Teh Young Khean, said the Kuala Lumpur office market continued to be under pressure during the quarter under review amid high impending supply and weak occupational demand.

Knight Frank Malaysia executive director of corporate services, Teh Young Khean, said the Kuala Lumpur office market continued to be under pressure during the quarter under review amid high impending supply and weak occupational demand.

According to the National Property Information Centre’s property market report for last year, office building completions in Kuala Lumpur were around 320,643 sq m, but the take-up rate was only for 24,646 sq m.

New supply of office space for Kuala Lumpur this year and next year is expected to be between 4.72 million and six million sq ft, respectively.

Among the mega real estate projects that will add on to the worrying supply of office space in Kuala Lumpur are the Tun Razak Exchange, KL118, Bandar Malaysia and Bukit Bintang City Centre.

Teh believes that landlords, faced with current challenges in the market, may be more willing to make concessions.

Singapore, which expects its prime-office leasing market to bottom out next year, is also facing a similar decline in rental earnings, the index showed.

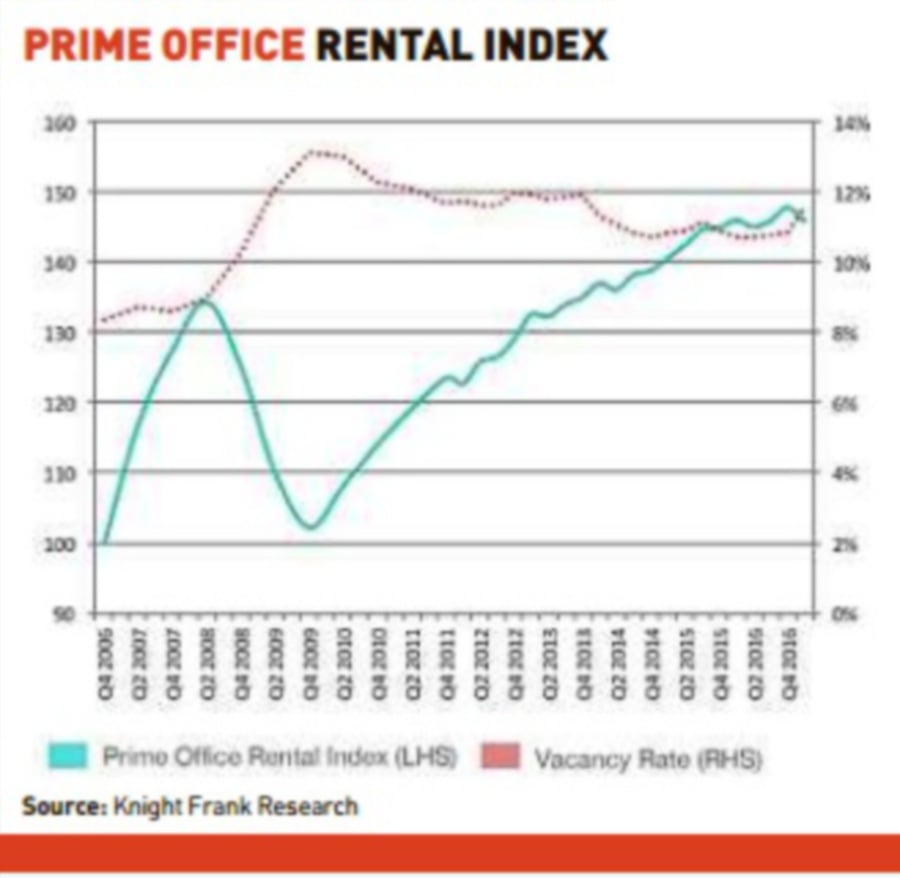

The Asia-Pacific Prime Office Rental Index was launched recently. It sees the addition of Manila, bringing the total number of markets tracked to 20.

The Asia-Pacific Prime Office Rental Index was launched recently. It sees the addition of Manila, bringing the total number of markets tracked to 20.

For the first quarter of this year, the index grew one per cent quarter-on-quarter due to rising rents in 10 of the markets over the quarter, with rental declines experienced in five of the 20 markets tracked.

Knight Frank Asia Pacific head of research, Nicholas Holt, expects an improving outlook for Asia-Pacific prime office markets with stable economic growth strengthening occupier demands.

“United States political uncertainty, rising interest rates and Chinese capital controls all made waves during the first quarter of this year. Amid these uncertainties, however, global economic activity continued to gain momentum.

“With a moderate rise in commodity prices and improving market sentiment, these positive elements bode well for several Asia-Pacific prime office markets for the rest of the year,” said Holt.

Over the next 12 months, Knight Frank expects rents in 15 out of the 20 cities to either remain steady or increase, which is up from 12 in its previous forecast.

Bangkok continues its strong performance, recording both the highest year-on-year (9.6 per cent) and quarter-on-quarter (3.1 per cent) growth rates in Asia-Pacific.

Rents have been increasing for more than two years and it may persist due to strong absorption amid tight supply.

China’s prime office market seemed to be moving positively.

Grade A office rents in Shanghai remained unchanged for the third consecutive quarter, as strong demand from fast-moving consumer goods and retail enterprises counterbalanced the completion of 720,000 sq m of prime space.

Similarly, Beijing welcomed 135,800 sq m of prime stock last quarter with rents staying high, as finance, Internet and high-tech sectors continue to drive leasing activity in the Chinese capital.

In Guangzhou, however, the vacancy rate declined by 3.5 percentage points to 13 per cent with no new prime office space coming on line during the quarter.

Mainland China companies remained the most important source of new take-up in central Hong Kong.

Landlords stayed aggressive due to limited supply, thus further pushing rental levels upwards.

Across Australia, all four major cities tracked saw their prime rents increase last quarter.

Strong demand continued to drive rental growth in Sydney and Melbourne central business districts, reinforced by these periods of little new development and stock withdrawals.

Net absorption for premium office buildings in Perth has benefited from the flight-to-quality with tenants relocating from Grade-A and below to higher quality premium space.

Brisbane experienced a decline in vacancy rate due to a combination of rising demand from the expanding state government workforce and the withdrawal of office stock.

Source : NST

Rents for older buildings in the Golden Triangle may come under pressure as landlords look for tenants to backfill space vacated by companies that are either downsizing or moving out of the area.

The Golden Triangle is the premium business district with a high concentration of tenants from the banking, insurance and services sector.

It is also Kuala Lumpur’s main shopping and nightlife district, as well as home to four- and five-star hotels.

According to the Knight Frank Asia-Pacific Prime Office Rental Index for the first quarter of this year, rent in Kuala Lumpur quarter-on-quarter declined by 0.9 per cent and 0.8 per cent respectively, with the market anticipating significant incoming supply this year.

According to the National Property Information Centre’s property market report for last year, office building completions in Kuala Lumpur were around 320,643 sq m, but the take-up rate was only for 24,646 sq m.

New supply of office space for Kuala Lumpur this year and next year is expected to be between 4.72 million and six million sq ft, respectively.

Among the mega real estate projects that will add on to the worrying supply of office space in Kuala Lumpur are the Tun Razak Exchange, KL118, Bandar Malaysia and Bukit Bintang City Centre.

Teh believes that landlords, faced with current challenges in the market, may be more willing to make concessions.

Singapore, which expects its prime-office leasing market to bottom out next year, is also facing a similar decline in rental earnings, the index showed.

For the first quarter of this year, the index grew one per cent quarter-on-quarter due to rising rents in 10 of the markets over the quarter, with rental declines experienced in five of the 20 markets tracked.

Knight Frank Asia Pacific head of research, Nicholas Holt, expects an improving outlook for Asia-Pacific prime office markets with stable economic growth strengthening occupier demands.

“United States political uncertainty, rising interest rates and Chinese capital controls all made waves during the first quarter of this year. Amid these uncertainties, however, global economic activity continued to gain momentum.

“With a moderate rise in commodity prices and improving market sentiment, these positive elements bode well for several Asia-Pacific prime office markets for the rest of the year,” said Holt.

Over the next 12 months, Knight Frank expects rents in 15 out of the 20 cities to either remain steady or increase, which is up from 12 in its previous forecast.

Bangkok continues its strong performance, recording both the highest year-on-year (9.6 per cent) and quarter-on-quarter (3.1 per cent) growth rates in Asia-Pacific.

Rents have been increasing for more than two years and it may persist due to strong absorption amid tight supply.

China’s prime office market seemed to be moving positively.

Grade A office rents in Shanghai remained unchanged for the third consecutive quarter, as strong demand from fast-moving consumer goods and retail enterprises counterbalanced the completion of 720,000 sq m of prime space.

Similarly, Beijing welcomed 135,800 sq m of prime stock last quarter with rents staying high, as finance, Internet and high-tech sectors continue to drive leasing activity in the Chinese capital.

In Guangzhou, however, the vacancy rate declined by 3.5 percentage points to 13 per cent with no new prime office space coming on line during the quarter.

Mainland China companies remained the most important source of new take-up in central Hong Kong.

Landlords stayed aggressive due to limited supply, thus further pushing rental levels upwards.

Across Australia, all four major cities tracked saw their prime rents increase last quarter.

Strong demand continued to drive rental growth in Sydney and Melbourne central business districts, reinforced by these periods of little new development and stock withdrawals.

Net absorption for premium office buildings in Perth has benefited from the flight-to-quality with tenants relocating from Grade-A and below to higher quality premium space.

Brisbane experienced a decline in vacancy rate due to a combination of rising demand from the expanding state government workforce and the withdrawal of office stock.

Source : NST

No comments:

Post a Comment